They can sue for lost profits if they think net zero leaves them out of pocket.

Nation states are on the hook to pay out over $100 billion in compensation claimed by fossil fuel, utility and mining companies since the turn of the 21st century – roughly equivalent to what they collectively spent on climate finance in 2022.

So what? This is not how the energy transition was supposed to work. To cut emissions, emitters need to be incentivised to stop. Instead they can bypass domestic courts and sue vulnerable states for huge sums using an arbitration system funded by the World Bank.

What? Investor State Dispute Settlements (ISDS) first appeared in post-colonial trade agreements as a mechanism for companies to claim forgone profit if their assets were seized by newly independent states. Nowadays…

- Cases are mainly brought by polluters and extractors against governments.

- They are heard by ICSID, a subsidiary of the World Bank whose remit, ironically, includes financing the energy transition in developing countries.

ICSID tribunals rely on expensive legal expertise, which developing countries often have trouble accessing. According to a UN report, this creates “obvious risks of bias” and contributes to “regulatory chill” for countries trying to implement net zero plans.

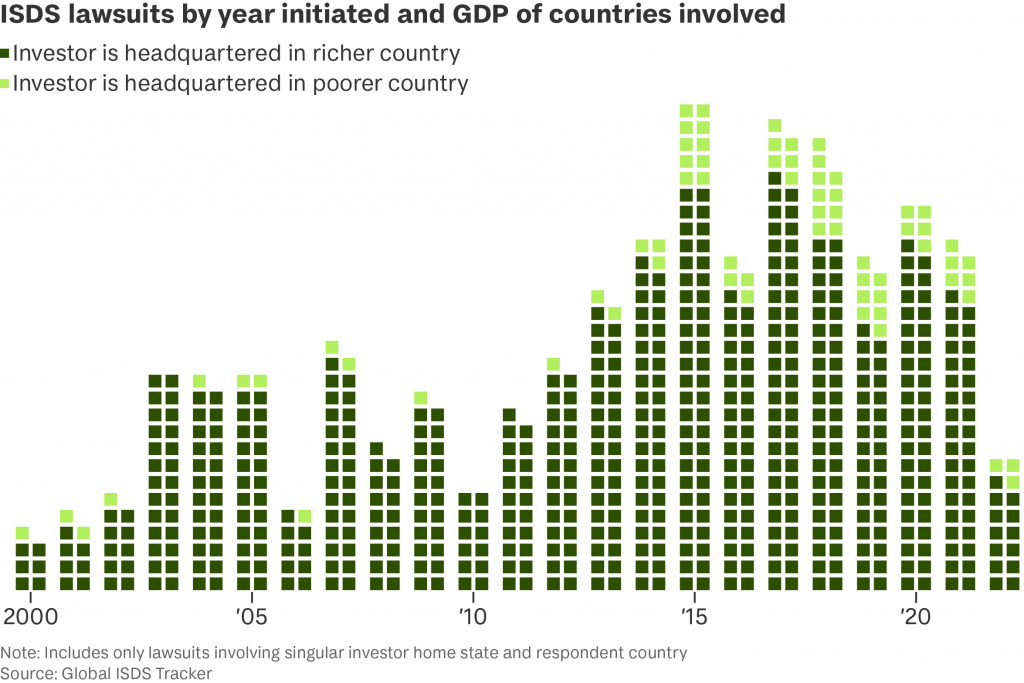

Awards in many cases remain undisclosed, but a new searchable tracker of 1,362 cases filed since 1998 reveals:

- $87.7 billion of taxpayers’ money awarded to fossil fuel and mining giants including Chevron, Shell and Glencore.

- A sharp increase in claims over $1 billion.

- 1156 out of 1362 cases (almost 85 per cent) were filed by investors from rich western countries, according to calculations by PowerShift, an NGO that co-created the tracker.

“Trade agreements don’t usually state how much compensation should be given if treaties are breached,” says Kyla Tienhaara, an expert in ISDS from Queen’s University, Ontario. “Arbitration tribunals have a lot of discretion and a lot of them have been making decisions that investors deserve ‘lost future profits’… It’s a ludicrous system.”

- Tethyan Copper vs Pakistan. In 2019, ICSID ordered Pakistan to pay $5.8 billion to a joint-venture part owned by UK-listed Antofagasta, for a gold mine that had never been built. The award was released less than two weeks after the IMF agreed a loan of $6 billion to help Pakistan navigate an economic crisis. In the end Pakistan struggled to meet the payments and the mine was dug anyway.

- Prospera vs Honduras. ISDS isn’t just a concern for environmentalists. Last year a US company backed by a group of crypto-libertarians (including Peter Thiel and former World Bank chief economist Paul Romer) sued Honduras for $10 billion after it reneged on a commitment to build a low-tax Special Economic Zone on the island of Roatan.

- PMI vs Australia. The best known of these disputes is probably Philip Morris’ attempt to overturn plain tobacco packaging laws in Australia under a bilateral trade agreement with Hong Kong. The lawsuit was thrown out in 2015 but PMI persisted with similar claims against Uruguay and Togo. A legal letter from Philip Morris West Africa to the government of Togo threatened “an incalculable amount of international trade litigation” if it changed packaging rules. Togo backed down.

Just deserts? Sentiment is turning against ISDS in rich countries. Earlier this year the UK left the EU’s Energy Charter Treaty (ECT), an agreement that allowed investors to sue countries with climate targets for forgone returns.

“We’ve reduced the chilling effect of the ECT by having governments withdraw from it. The most powerful board members of the World Bank could do the same by saying ‘we’re no longer going to support the use of ICSID powers to undermine our [climate change] efforts,’” says James Cameron, chair of Crown Agents and a COP advisor.

What’s more… Under the new leadership of Ajay Banga, the World Bank has set an ambitious target of providing $40 billion in climate finance by 2025. But if it truly seeks “to create a world free from poverty on a livable planet” it must first tackle the problems with its corporate court.

An ICSID spokesperson said: “Ensuring that states and investors have an effective means to resolve grievances under treaties and contracts is an important part of the energy transition… Cases are decided on their merits by independent tribunals without bias in favour of any economic sector.”