Investors’ search for a safe haven means illegal mining is more lucrative than ever

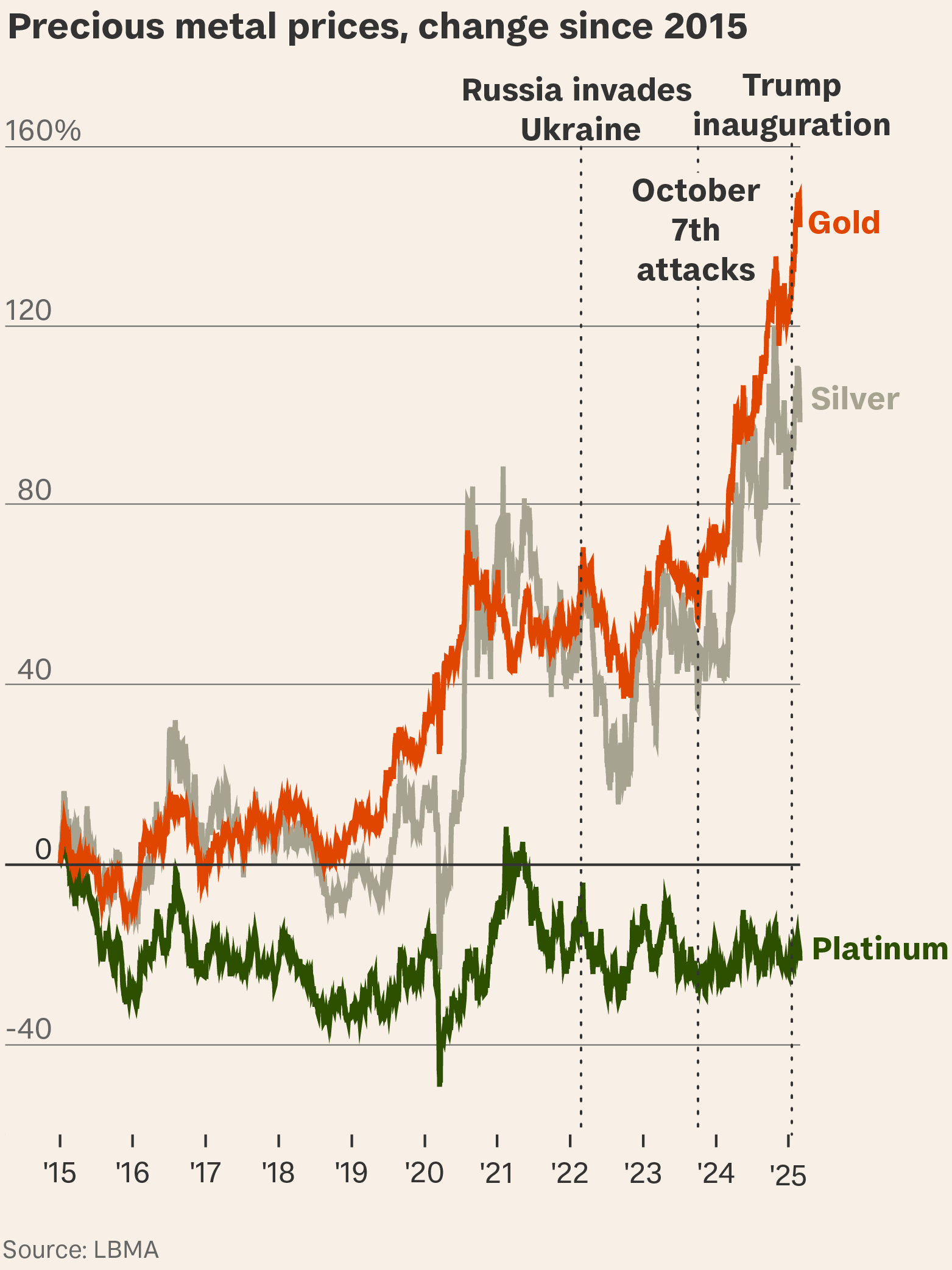

The price of gold keeps breaking records. Before a slight fall last week it hit nine record highs in February, and it’s forecast to reach $3,000 per ounce at the end of the year.

So what? This is a Trump spike. Gold prices always fluctuate and typically rise in times of uncertainty as demand for safe-haven assets grows. But fears of the impact of Trump’s proposed tariffs are driving up prices, and with them concerns for workers in illegal mines in Africa.

The price of gold has been climbing for a few years, mainly driven by the pandemic, the war in Ukraine, inflation, the war in Gaza and an increase in gold buying by central banks.

But this year

- Donald Trump proposed 25 per cent tariffs on Mexican and Canadian goods, expected to take effect today, with an extra 10 per cent duty on Chinese imports;

- the price of gold has already risen about 9 per cent, on top of last year’s 25 per cent gain:

- US prices have surged even higher on fears that gold could be included in Trump’s tariffs;

- the spike in demand for gold in New York – the global hub for trading gold futures (contracts representing gold) – led to long queues to get bars out of vaults in London, where the physical market for gold is based.

If a full-blown trade war broke out, gold would be the best performing asset, according to a majority of global fund managers recently surveyed by Bank of America.

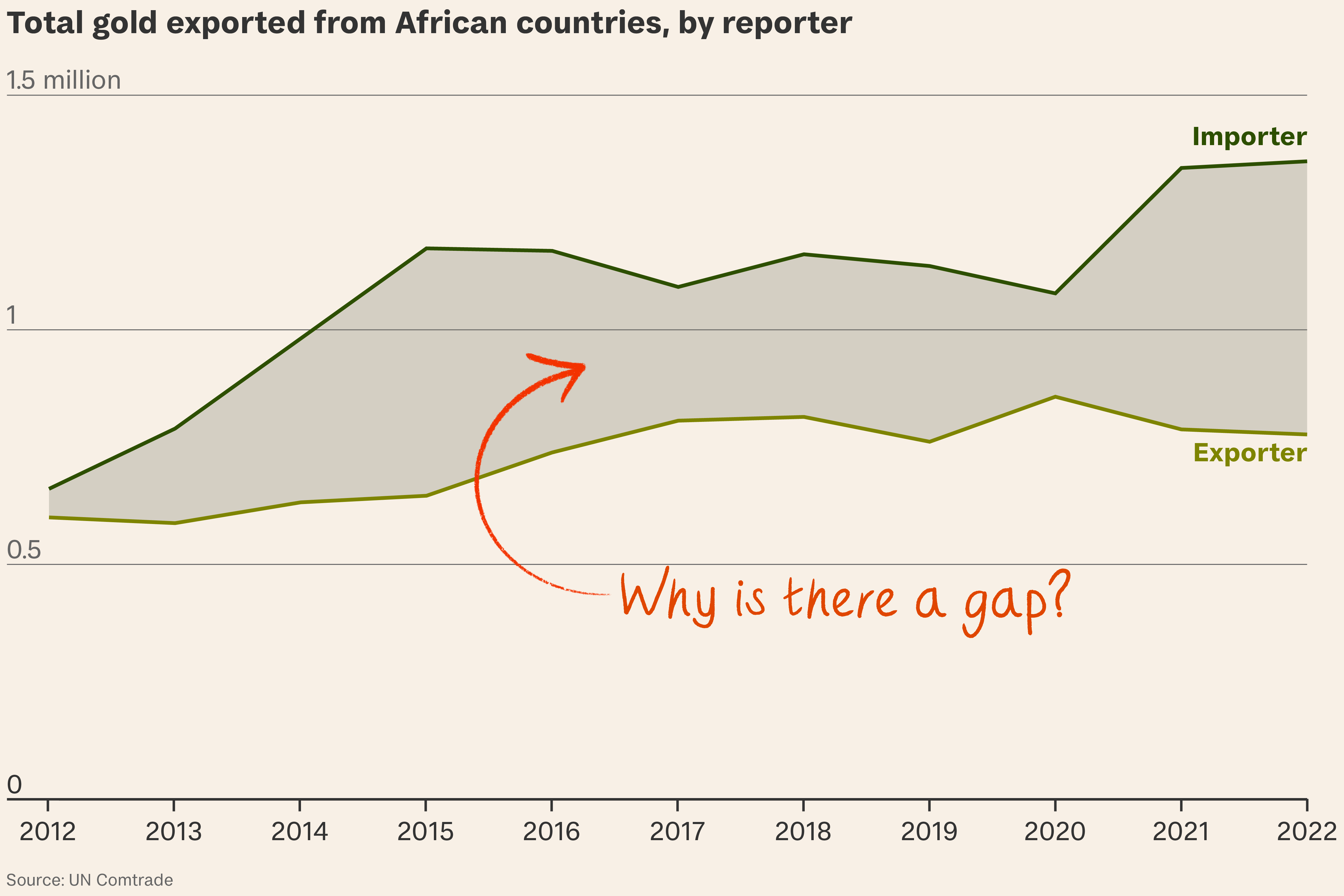

This means that more people will try to get hold of it, says Marc Ummel, head of unit raw materials at Swissaid, “with more illegal mining and increased conflict linked to gold”.

In parts of Africa – particularly the Sahel, Ghana, Zimbabwe and South Africa – artisanal and small-scale mining employs about 80 per cent of the gold mining workforce, and most of its gold extraction goes undeclared.

According to a Swissaid report, gold smuggling in Africa has more than doubled over the past decade, severely affecting livelihoods. Since the start of this year alone

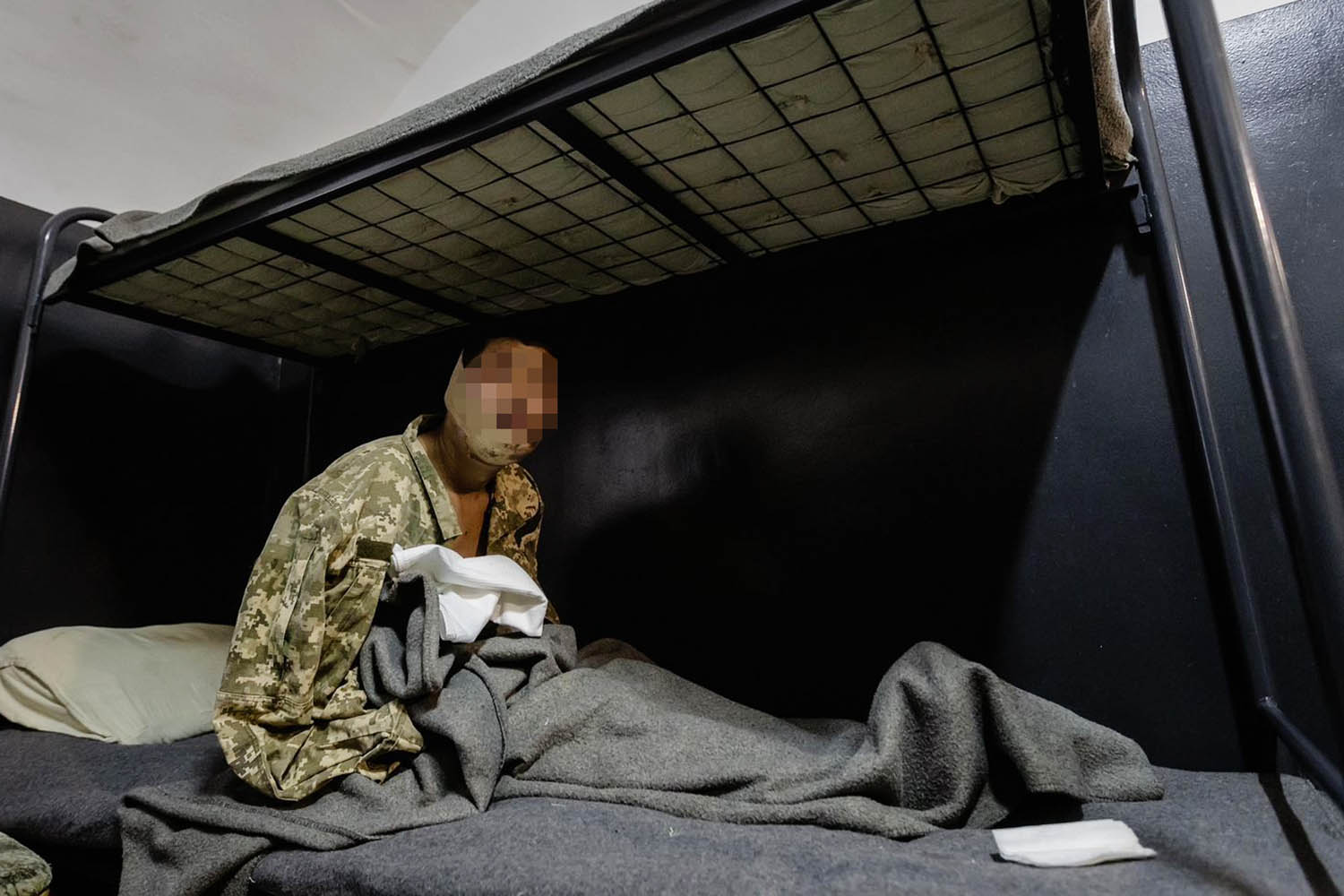

- at least 87 people, mostly immigrants, have died in an abandoned illegal gold mine in South Africa; and

- more than 40 people, mostly women, died when an illegal gold mine collapsed in Mali.

Increased revenue from gold also continues to finance the civil war in Sudan – which has almost doubled gold production since pre-war levels in 2022 – and is contributing to newly erupted violence in eastern Congo.

What’s more… gold has grown in the public consciousness too: Trump and Musk say they plan to go to Fort Knox, the military base that houses about half the US government’s gold reserves, “to make sure the gold is there”. Assuming all 147 million ounces said to be there actually are, they’re worth about $415 billion.