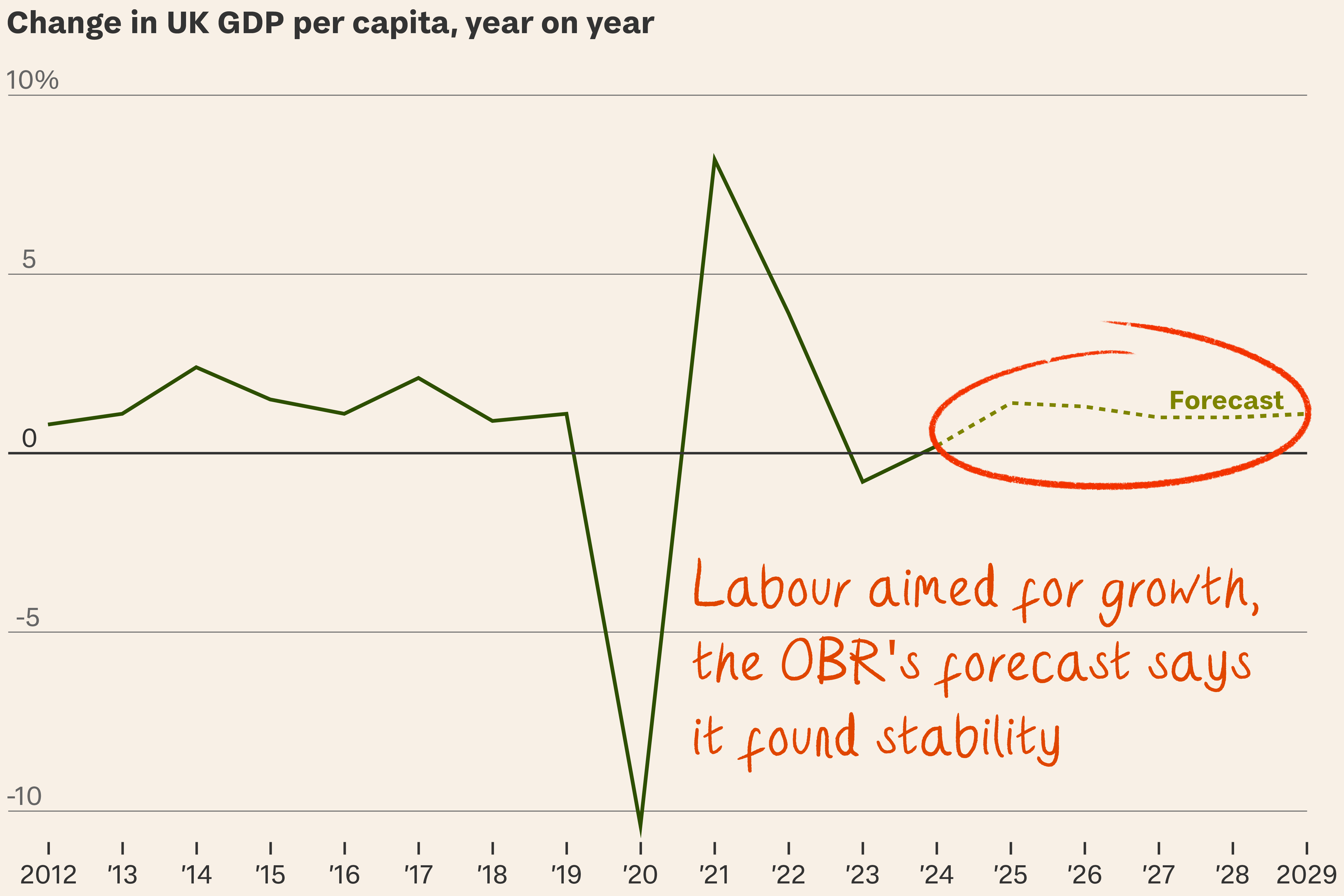

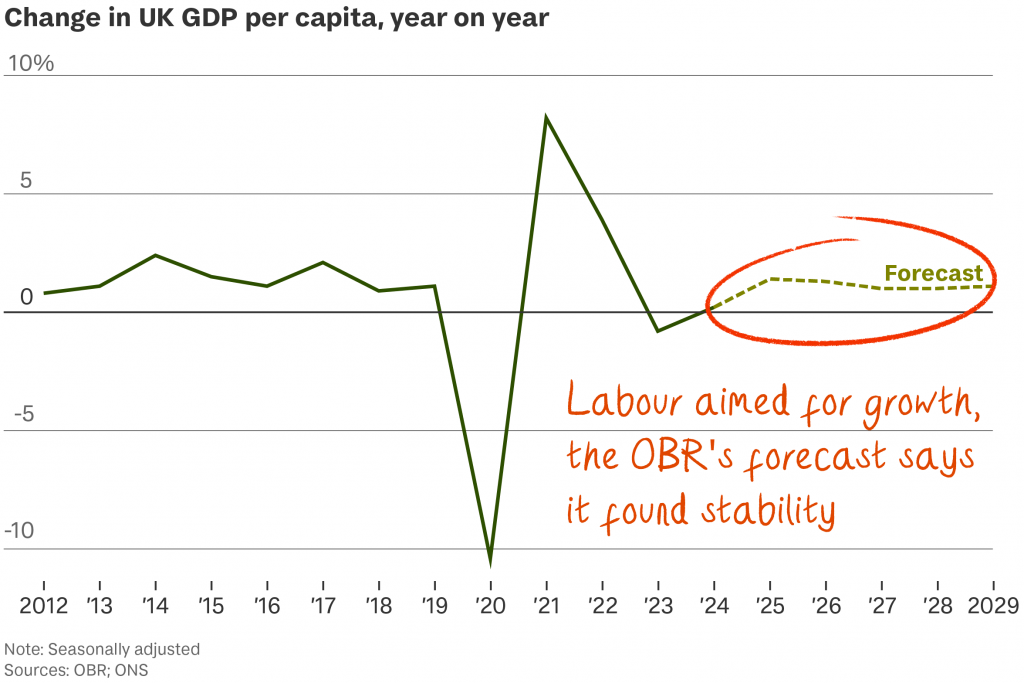

It looks like she will achieve stability. Whether that leads to growth is another matter

Labour’s first Budget in more than 14 years is likely to dampen wages, erode savings, increase inflation in the short-term and leave GDP growth largely flat over the course of this parliament.

So what? That’s not necessarily bad. The chancellor’s plan redirects money from employers to public services, which many voters believe are broken after a decade of austerity. This was not the “growth budget” that was billed – but it could still pay off for Labour in 2029.

Rachel Reeves made history yesterday

- as the UK’s first female chancellor to deliver a Budget;

- by dramatically expanding the size and scope of the British state; and

- by ushering in a return of traditional left-right politics.

Big state. As expected, Labour will raise taxes (by £40 billion) and borrowing (by £30 billion) to fund new public spending (of £76 billion). Overall public spending will settle at 44 per cent of GDP by the end of the decade, much closer to European than US norms. As expected, Rishi Sunak responded for the Conservatives with words to the effect of “we told you so”.

Big bet. Reeves’s gamble was that an extra £100 billion in capital investment over five years would deliver enough growth for her not to have to raise taxes again soon. The IMF backed her, but the Office for Budget Responsibility (OBR) says the return on that investment won’t come until the next parliament.

Big bill. The chancellor told MPs she was restoring stability. That may be true – bond yields fluctuated yesterday within reasonable bounds and the FTSE 100 shrugged – but stability comes at a cost. As well as redefining debt to take into account the UK’s financial assets alongside liabilities, Reeves followed through on briefings that she would

- raise employers’ National Insurance contributions by 1.2 percentage points to 15 per cent;

- raise the lower rate of capital gains tax from 10 per cent to 18 per cent and the higher rate from 20 per cent to 24 per cent; and

- extend the freeze on thresholds for inheritance tax until 2030.

These are the outlines of the UK’s biggest package of tax increases in a generation.

Pedigree. Reeves paid homage to the Labour budgets that “rebuilt” Britain in 1945, 1964 and 1997 – and that of 2024 is certainly comparable in ambition.

Health. A (valid) premise of her plan is that shambolic public services are a drag on growth. One of its centrepieces will be an extra £22 billion a year for day-to-day NHS running costs, with another £3 billion for capital investment.

Education. There will be an extra £6.7 billion in capital funding for schools, including £1.4 billion to help rebuild hundreds of crumbling state school buildings. The scale of the funding recalls Blair’s academies programme. Unlike Blair, Reeves will raise some of it by charging VAT on private fees.

Redistribution. The National Living Wage will jump by an above-inflation 6.7 per cent to £12.21 an hour.

What about growth? As things stand there will be some, but not enough. The OBR says Reeves’s plan will boost growth “temporarily… but leave GDP largely unchanged in five years”. It says the Budget will also result in

- earnings “stalling” for two years as employers pass on the cost of higher NICs to employees;

- disposable income slowing “sharply”;

- households “significantly” running down their savings;

- inflation increasing by 0.4 per cent; and

- mortgages rising.

Gilty feelings. Yet another concern is the potential impact of the chancellor’s fiscal loosening on inflation, to which bond markets responded yesterday with a mini-sell-off that pushed the 10-year gilt yield to a five-month high. This was no Liz Truss-style crisis; more a reminder of the importance of stability in its lingering aftermath.

What’s more… Yesterday’s growth forecasts could still be revised up. Known unknowns include how the billions earmarked for investment will be spent, and how much growth might be unlocked by Labour’s proposed planning reforms, which aren’t yet law. Even more than usual, the UK economy is a work in progress.

Additional reporting by Barney Macintyre.