Whether it’s despite or because of Trump is not yet clear

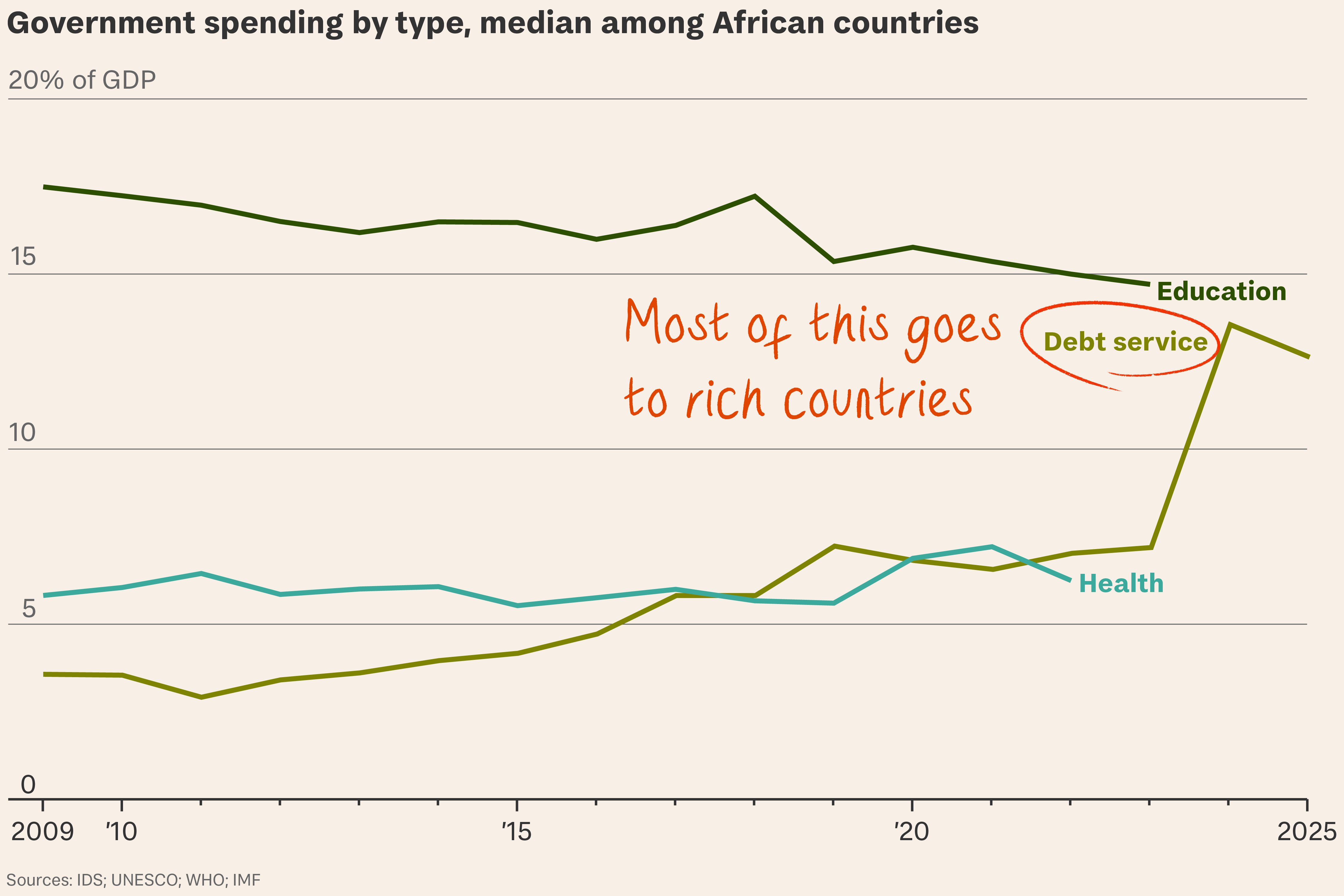

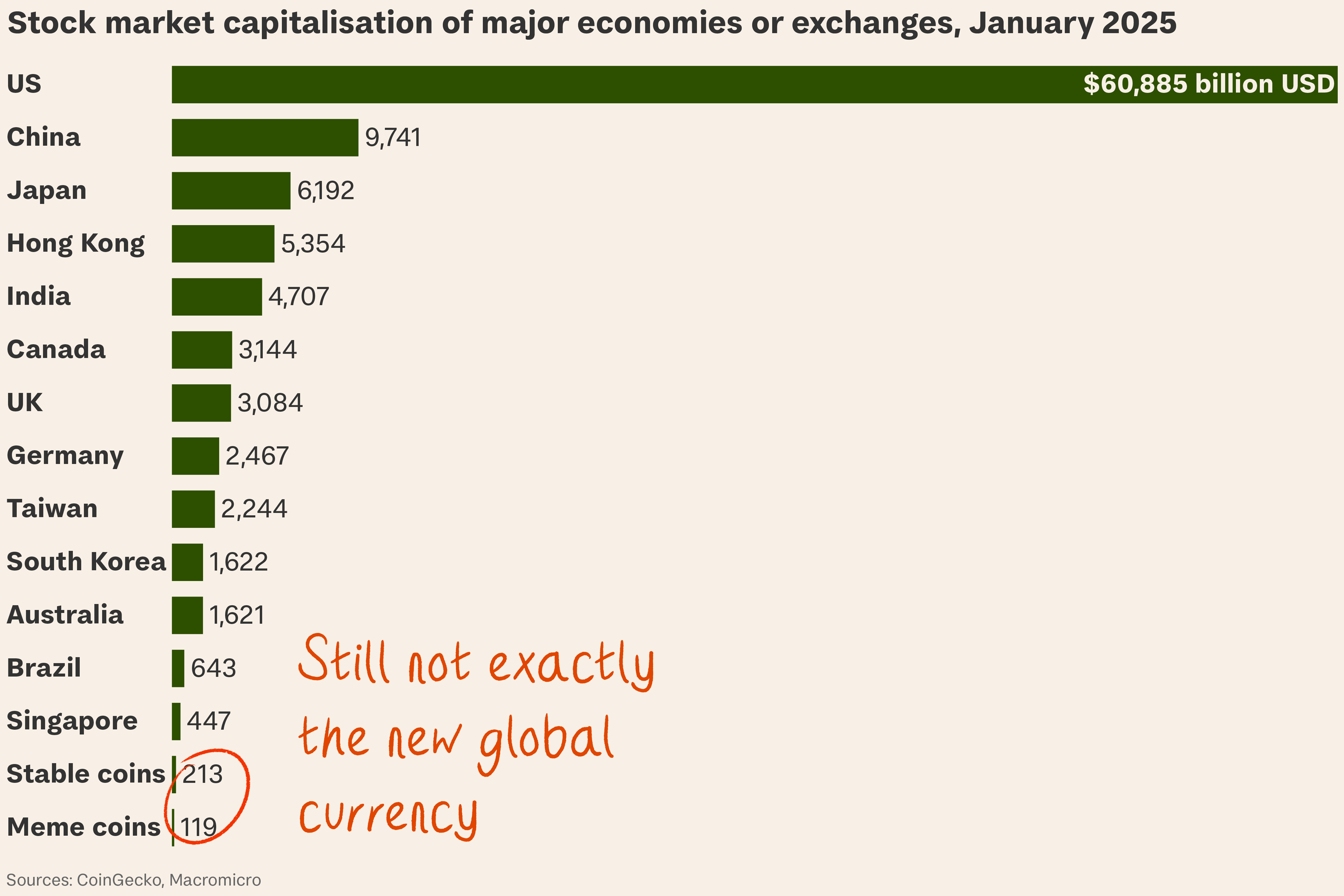

Last year, stablecoin transactions – in cryptocurrency, but pegged to the dollar – totalled $24 trillion, with a t.

So what? Crypto is back. In truth, it never went away. It created a bubble that burst three years ago but steadily reflated, and it now boasts

- a devoted grassroots following (half a billion users and millions signed up to online pressure groups in the US alone);

- an increasingly enthusiastic embrace by traditional finance (BlackRock’s CEO calls Bitcoin – now trading at $102,000 – “digital gold”); and

- a convert in the White House.

The $Trump factor. The new presidency has been welcomed as “a new dawn” by crypto champions in Davos, even though the same champions winced when Donald Trump launched a meme coin in his own name last Friday and his wife followed suit two days later.

- Meme coins are highly volatile crypto-based assets with no underlying value.

- As of Wednesday, $TRUMP is worth $8 billion, $MELANIA $760 million – numbers likely to fluctuate with their popularity.

- Both coins blur the boundaries of presidential office and private enterprise. A disclaimer says they are “not intended to be... an investment opportunity”.

- To industry insiders, they suggested Trump either isn’t taking crypto seriously or doesn’t understand it.

But Potus. At a minimum the US presidency sets priorities. This one has Congress onside and though he once called crypto a “scam” he’s now calling himself the first crypto president. His views may have changed when the industry’s leading super Pacs spent more than $170 million backing his campaign. In return it’s expecting what it calls clarity on regulation. Translation: ultra light-touch regulation, if any.

And Elon. At the zenith of America’s new oligarchy, Musk is a crypto devotee whose new quasi-autonomous government department is named after Dogecoin, his favourite crypto. His brother, Kimbal Musk, said last night in Davos: “The crypto world has gone into the belly of the beast and now it’s back again, flush with resources, and it’s very exciting.”

A turning point, at least.

- Brian Armstrong, CEO of the Coinbase crypto exchange, told a panel this week Trump’s “unprecedented” support for crypto marked a sea change from the Biden administration, which he accused of trying to “illegally kill” the industry through overregulation.

- Anthony Scaramucci, a former Republican White House communications director turned vocal Trump critic, said the reluctance of Democrats to get behind the technology cost them the “presidency, the House and the Senate”.

They would say that. The World Economic Forum has long been criticised as detached from reality – a phenomenon known as “Davos disconnect”. Crypto is vulnerable to the same critique: South Africa's central bank chief told the same panel Bitcoin made no more sense as a reserve asset than beef or apples.

But beneath the volatility, the use of crypto for payments has been steadily increasing. Armstrong says the industry is still in its infancy. From 500 million users now in a world of eight billion, Armstrong said “it'll get to half the world in 10-15 years”.

A new politics. Trump is not at Davos, but a new political divide has crystallised in the shadow of his victory: progress versus stasis. The libertarian right sells itself as the movement of relentless innovation and dynamism; the left, it says, is defensive and overregulated. Big Tech is all in.

To some otherwise enthusiastic industry insiders, $TRUMP felt like a misstep. But on Tuesday Trump threw his crypto backers a bone by granting a pardon to the Bitcoin pioneer Ross Ulbricht, creator of the Silk Road dark web drug marketplace. He told Ulbricht’s mother he did it “in honor of her and the Libertarian Movement, which supported me so strongly”.

Sucker punch. Looking down on Davos from the hotel where Thomas Mann set The Magic Mountain, a quantum physicist-turned-entrepreneur said in passing yesterday that as soon as quantum decryption becomes a reality – which the US government expects to be by 2030 – “bitcoin goes to zero”.