Donald Trump’s investors are betting on the man rather than his social media platform.

On Tuesday, shares in Donald Trump’s social media company rose 16 per cent on its stock market debut. On Wednesday they rose again, closing up 30 per cent overall.

So what? On paper at least, Trump is roughly $5 billion richer. A week that began with his business empire facing threats of asset seizure ends with Trump joining Bloomberg’s list of the world’s wealthiest 500 people for the first time. It also

- gives him a possible path through his current cash crunch, subject to small print;

- raises questions about Truth Social’s real value; and

- gives an insight into the strength of his political support.

The whole truth. Trump launched the Truth Social social media platform as his personal microphone after he was banned from Twitter and Facebook following the January 6th Capitol riots.

- In October 2021, the platform’s parent company, Trump Media & Technology Group, proposed a merger deal with Digital World Acquisition Corporation, a special purpose acquisition company, or Spac, that exists to take businesses public without an IPO.

- That merger closed on Monday. TMTG started trading on the Nasdaq on Tuesday under the ticker symbol “DJT” (guess who), with trading briefly halted because of extreme volatility.

Meme stock. Held up to the light, the current $9 billion valuation of TMTG looks extremely bubbly on at least three counts:

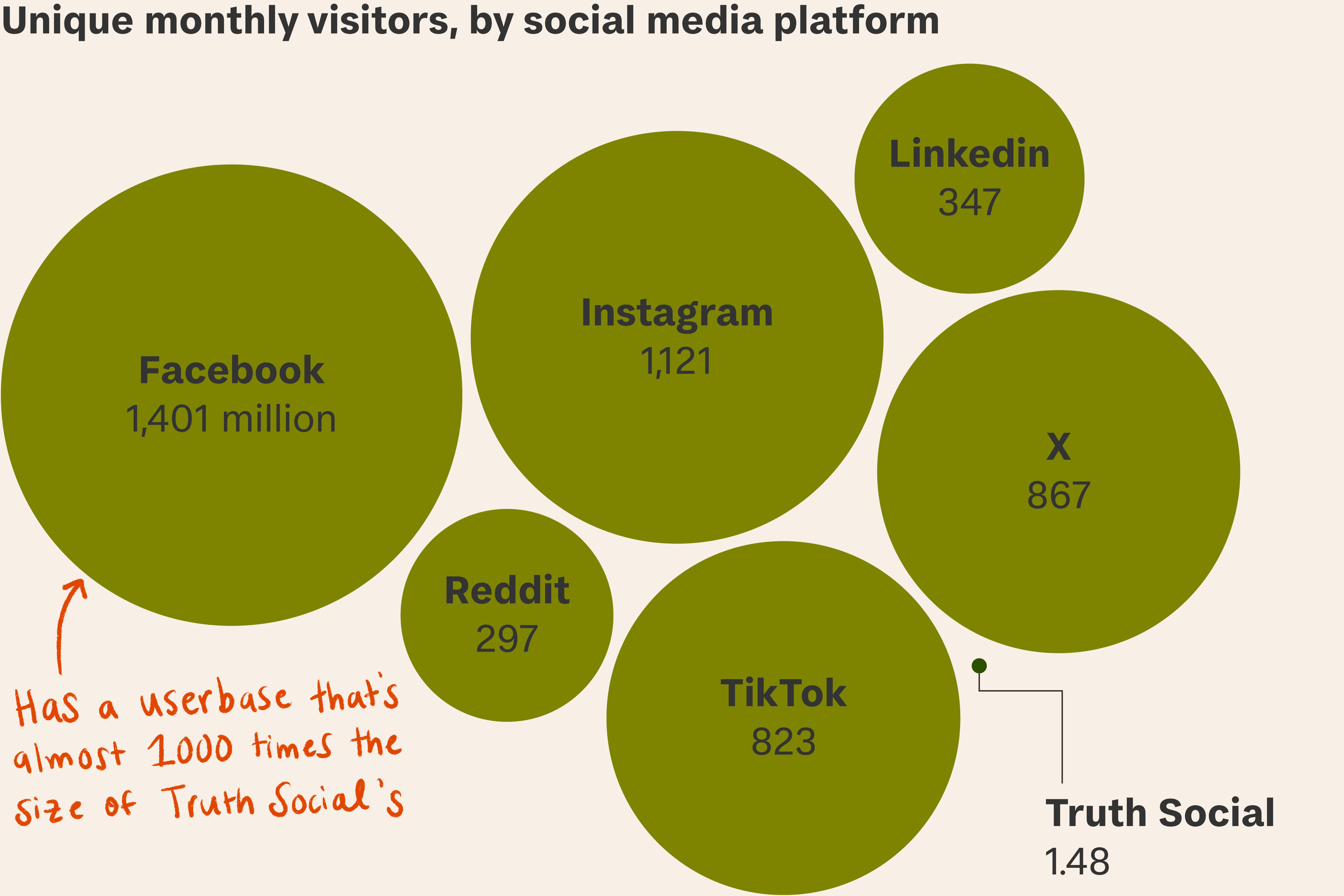

- Users. Truth Social has about 8.9 million sign-ups (it doesn’t publish active users). Facebook had 845 million monthly active users when floated in 2012, according to Axios, while Twitter had 215 million before it went public in 2013. At peak froth on Tuesday, Truth Social was valued at over $1,000 per signed-up user, compared with $147 per active user for Reddit and $46 for Snapchat.

- Revenue. In the first nine months of last year, Trump Media generated $3.4 million in revenue and lost $49 million. The company says it expects to remain lossmaking “for the foreseeable future”.

- Trump. Trump Media noted in a Securities and Exchange Commission filing that “Donald J. Trump is the subject of numerous legal proceedings, the scope and scale of which are unprecedented” and an “adverse outcome… could negatively impact TMTG and its Truth Social platform”.

Riding on faith. But traders in TMTG stock are mainly retail investors – who trade for themselves in small quantities – and Trump fans. On Truth Social on Tuesday, one user urged conservatives to send the DJT stock over $100 per share to “drive the liberals insane!”.

Chad Nedohin, who tracked the merger deal on Rumble, referenced the Biblical proverb “buy the truth, and sell it not” on a recent livestream. “Literally, as a team of investors, we have bought into truth and we are never selling,” he said.

“The valuation at this stage is completely detached from business reality,” according to Niamh Burns, analyst at Enders Analysis. “But it’s not really about business—these investors are just betting on Donald Trump.”

Caveat emptor. Trump still has a $464 million New York civil fraud judgement hanging over him – although a court ruled on Monday that he could put up a bond for $175 million while he appeals the ruling. Facing further legal costs and an expensive presidential campaign, Trump has used a range of fundraising efforts (see: gold trainers). On Tuesday, he started promoting a $59.99 Bible on Truth Social.

TMTG’s share price is unlikely to help him immediately because of a lock-up agreement that prevents him from selling his stock or using it as collateral for a loan for six months, says Michael Ohlrogge of New York University School of Law.

- Trump could get around this with the permission of the board, which includes former members of his administration and his eldest son.

- But if Trump sells his stock and that causes the price to drop, it leaves the company vulnerable to lawsuits from shareholders.

- Another problem with getting a loan is the true, long-term value of the shares are “likely a tiny fraction” of their current trading price, says Ohlrogge, adding risks for the lender.

- This in turn raises the concern that anyone who extends such a loan might not be doing it as an investment but as a way to win political favour.

What’s more. Trump took his hotel and casino company public on the New York Stock Exchange in 1995. Stock prices did well for a time, reaching a high of $35 a share. By 2004, the company filed for bankruptcy protection.

More than 70 countries are holding elections this year, but much of the voting will be neither free nor fair. To track Tortoise’s election coverage, go to the Democracy 2024 page on the Tortoise website.